Which policy is more likely to have higher initial premiums?

Whole life insurance usually has higher initial premiums because it provides lifelong coverage and accumulates cash value, unlike term life insurance.

Why might someone choose term life insurance over whole life insurance?

Term life insurance is often chosen for its lower cost and specific coverage period, making it suitable for temporary financial obligations like a mortgage.

Which type of insurance typically requires a medical exam?

Both term and whole life insurance often require a medical exam to assess the applicant’s health and determine premiums.

Can you convert term life insurance to whole life insurance?

Many term life insurance policies allow conversion to whole life insurance within a specified period without requiring additional medical underwriting.

Which of the following is a feature of term life insurance?

Term life insurance is known for its lower premiums compared to whole life insurance because it provides coverage only for a specific period and does not accumulate cash value.

What is a common feature of whole life insurance that is not found in term life insurance?

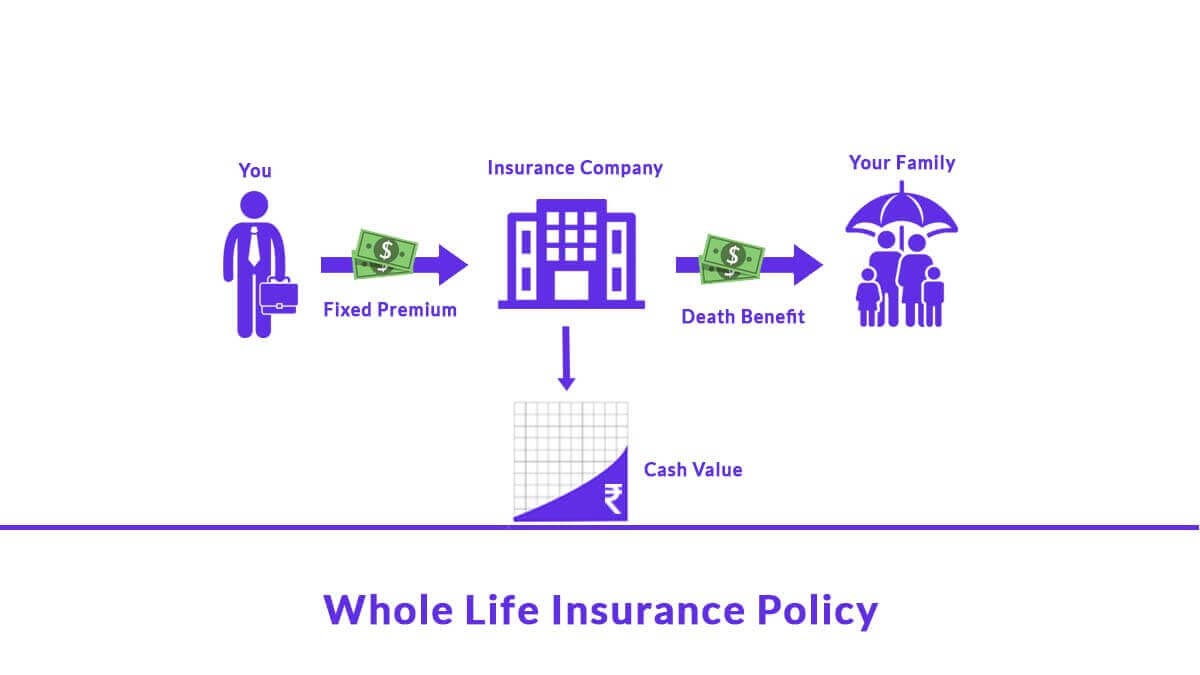

Whole life insurance builds cash value, which can be accessed through loans or withdrawals, a feature not available in term life insurance.

Which insurance type might someone choose if they want coverage that also serves as an investment?

Whole life insurance can serve as an investment vehicle due to its cash value component, which grows over time and can be borrowed against or used for other financial purposes.

If you outlive your term life insurance policy, what is a common next step?

If you still need coverage after your term policy expires, you can apply for a new term policy, though the premiums may be higher due to your increased age.

How does the cost of whole life insurance compare to term life insurance over time?

Whole life insurance tends to be more expensive because it provides lifelong coverage and has a cash value component.

What happens when a term life insurance policy expires and you’re still alive?

Once a term life insurance policy expires, the coverage ends. No benefits are paid out, and the premiums are not refunded.

Which type of life insurance generally has lower premiums?

Term life insurance usually has lower premiums because it only provides coverage for a specific period and doesn’t accumulate cash value.

What is the main advantage of term life insurance for young families?

Term life insurance is often chosen by young families for its affordability and simplicity, offering financial protection during key years without the added cost of cash value accumulation.

What is the primary difference between whole life and term life insurance?

Whole life insurance not only provides a death benefit but also accumulates cash value over time. Term life insurance only provides a death benefit without cash value.

What happens if you stop paying premiums on a whole life insurance policy?

If you stop paying premiums on a whole life insurance policy, it may lapse, or the cash value could be used to keep the policy in force, but this would reduce the overall coverage.

What happens to the cash value of a whole life policy if you surrender it?

If you surrender a whole life policy, you receive the cash value minus any fees or outstanding loans.

Who would benefit most from a whole life insurance policy?

Whole life insurance is ideal for those who want lifelong coverage and are interested in the cash value aspect, which can be part of a long-term financial plan.

What is the main reason someone might choose a whole life policy over a term life policy?

Whole life insurance is chosen for its lifelong coverage and the ability to accumulate cash value, which can be used for loans, withdrawals, or to pay premiums.

Which policy type allows you to borrow against it?

Whole life insurance accumulates cash value that can be borrowed against, unlike term life insurance, which has no cash value.

Which type of insurance is better for someone looking for lifelong coverage?

Whole life insurance provides coverage for your entire life, whereas term life insurance only covers a specific period.

How is the death benefit in a whole life insurance policy different from that in a term life policy?

The death benefit in a whole life insurance policy is guaranteed for the policyholder's entire life, as long as premiums are paid, unlike term life insurance which only covers a specific period.

Life insurance serves as a crucial financial tool designed to provide financial protection for your loved ones in the event of your passing. It can help cover expenses, pay off debts, and ensure that your family is financially secure. However, choosing the right type of life insurance is essential to align with your personal and financial goals.

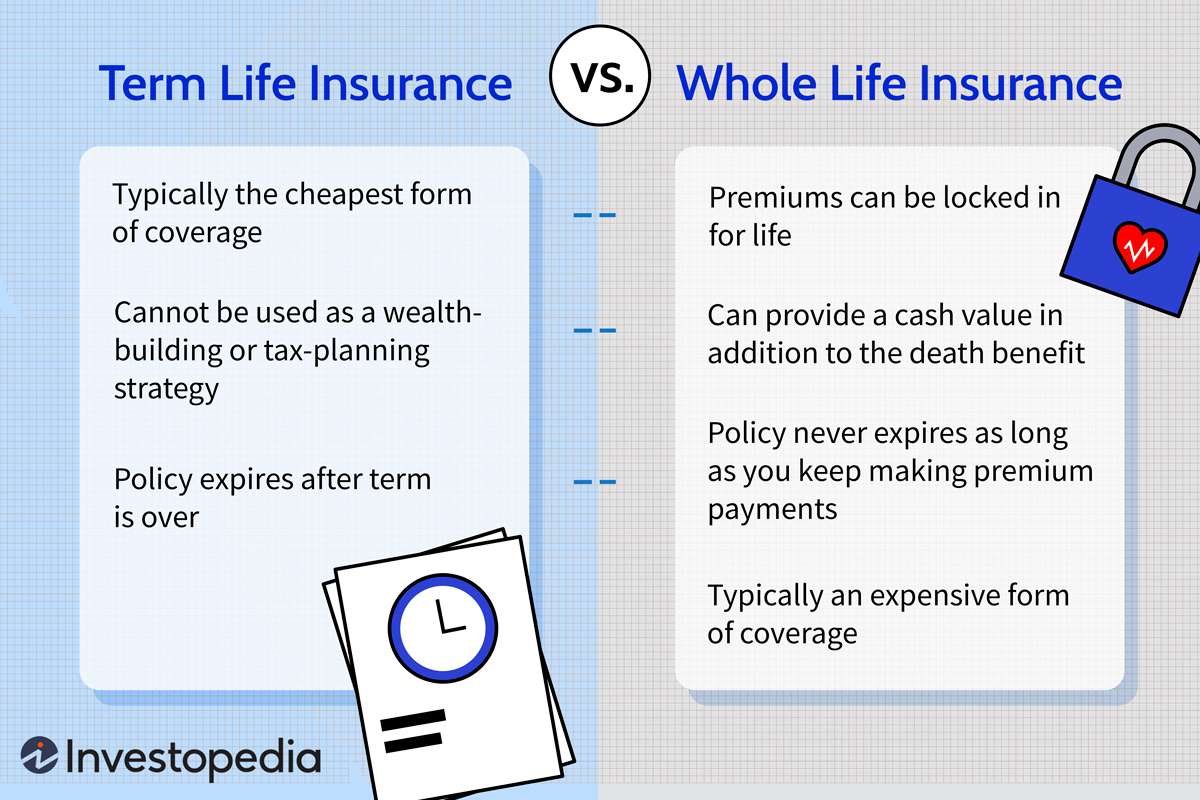

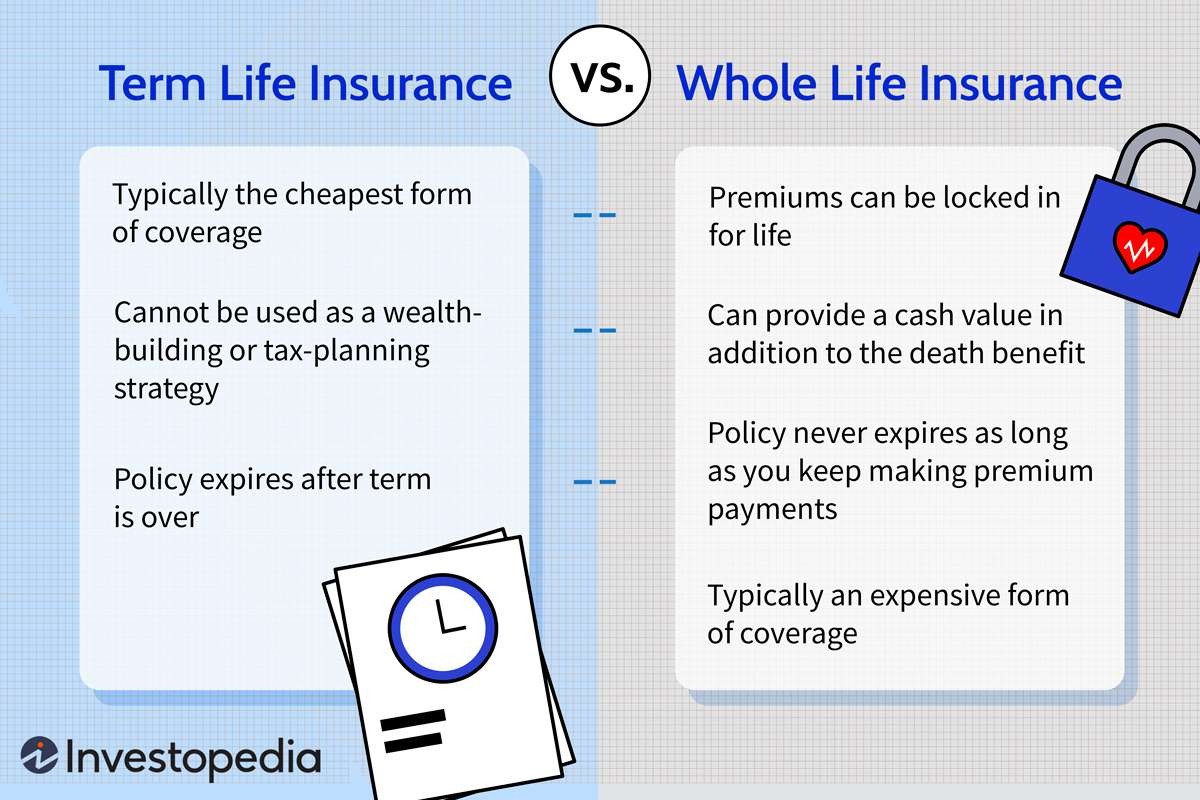

In the realm of life insurance, two primary types stand out: whole life insurance and term life insurance. Whole life insurance offers permanent coverage and includes a savings component, while term life insurance provides coverage for a specified period and is generally more affordable. Understanding the differences between these two types of insurance will help you make an informed decision based on your needs, budget, and long-term objectives. This comparison will explore the features, benefits, and drawbacks of each type, ultimately guiding you towards selecting the most suitable option for your situation.

Also Read: Homeowners Insurance: What Does It Really Cover?

Whole Life Insurance

Whole life insurance is a form of permanent insurance that provides coverage for the entirety of your life, as long as the premiums are paid. Unlike term life insurance, which expires after a specified period, whole life insurance ensures that a death benefit will be paid out no matter when you pass away.

One of the defining features of whole life insurance is its fixed premiums. This means that the amount you pay for your insurance will remain consistent throughout the life of the policy, offering predictability and stability in your financial planning. In addition to providing a death benefit, whole life insurance policies accumulate cash value over time. This cash value grows at a guaranteed rate and can be borrowed against or used to pay premiums, offering a degree of financial flexibility.

The cash value component of whole life insurance can also be used as an investment tool, contributing to long-term savings and estate planning. This added benefit makes whole life insurance appealing to those looking for a dual-purpose policy that combines insurance protection with an investment opportunity.

Term Life Insurance

Term life insurance is a straightforward and cost-effective form of life insurance that provides coverage for a specific period, known as the term. Common term lengths include 10, 20, or 30 years. If the insured person passes away during the term, the policy pays out a death benefit to the beneficiaries. However, if the term expires and the insured is still alive, the coverage ends, and no benefits are paid out.

One of the key advantages of term life insurance is its affordability. Because it is designed to provide protection for a finite period and does not accumulate cash value, the premiums are generally lower compared to whole life insurance. This makes term life insurance an attractive option for individuals who want to ensure financial protection for their family without a substantial financial commitment.

Term life insurance is also appreciated for its simplicity. The policy’s purpose is clear—provide a death benefit if the insured passes away during the term—making it easier to understand and manage. Additionally, many term life insurance policies offer the flexibility to convert to a whole life policy or renew for another term upon expiration, though this may come with higher premiums.

Comparing Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, it’s essential to understand how they differ in terms of cost, coverage duration, and additional features.

Cost is one of the most significant differences between the two types of insurance. Whole life insurance typically comes with higher premiums, reflecting the policy’s permanent nature and the added benefit of cash value accumulation. In contrast, term life insurance is generally more affordable because it provides coverage only for a specified period and does not include a savings component. This cost difference can be substantial, particularly over the long term, and can impact your overall financial planning.

The duration of coverage is another critical distinction. Whole life insurance offers lifelong protection, ensuring that a death benefit will be paid out regardless of when you pass away, as long as premiums are paid. This permanence provides peace of mind and stability, making it suitable for those seeking long-term financial security. On the other hand, term life insurance provides coverage only for the length of the term you select, such as 10, 20, or 30 years. If you outlive the term, the coverage ends, and no benefits are paid. This can be an ideal choice for those needing coverage during specific life stages, such as while raising children or paying off a mortgage.

Making the Right Choice

Selecting the right type of life insurance involves careful consideration of your personal needs, financial goals, and circumstances. The decision between whole life and term life insurance should be guided by a thorough assessment of what you hope to achieve with your policy and how it fits into your overall financial plan.

First, evaluate your financial goals and needs. Consider how long you will need coverage and what financial responsibilities you want to address. Whole life insurance may be more suitable if you are looking for a long-term solution that provides lifelong protection and includes an investment component. This type of policy can be a part of a broader estate planning strategy and may be appealing if you have the means to handle the higher premiums and appreciate the cash value accumulation.

In contrast, term life insurance might be the better choice if you need affordable coverage for a specific period, such as while raising children or paying off a mortgage. The lower premiums make it an attractive option if you are seeking temporary protection and prefer not to commit to the higher costs associated with whole life insurance.

Conclusion

In navigating the decision between whole life and term life insurance, it’s important to weigh the distinct characteristics and benefits of each type. Whole life insurance offers lifelong coverage, fixed premiums, and a cash value component that can serve as both an investment and a financial tool for long-term planning. This makes it a strong choice for individuals seeking permanent protection and willing to commit to higher premiums in exchange for added financial security and estate planning benefits.

On the other hand, term life insurance provides a cost-effective solution for temporary coverage needs. Its lower premiums and straightforward nature make it accessible for those seeking affordable protection for a specific period, such as while raising a family or paying off significant debts. Though it does not offer a cash value component or long-term coverage, its simplicity and lower cost can make it an appealing option for many.